ANNOUNCEMENTS

Terms of Call – 403b

As I sat down to write this, I realized that I was assuming everyone knows about 403b retirement plans. So, let’s start at the beginning:

-

403b is a retirement plan that allows you to contribute money to it pretax.

-

It is the not-for-profit version of a 401K.

-

Pre-tax means that you do not pay federal withholding on the income until the funds are withdrawn.

Our Board of Pensions – through Fidelity – provides the vehicle for savings funds for retirement in a 403b.

At the time the funds are withdrawn you can avoid paying the taxes on the withdrawal by designating the funds as part of the housing allowance. Pastors in retirement continue to enjoy the benefits of the housing allowance by the designation of retirement income as housing allowance.

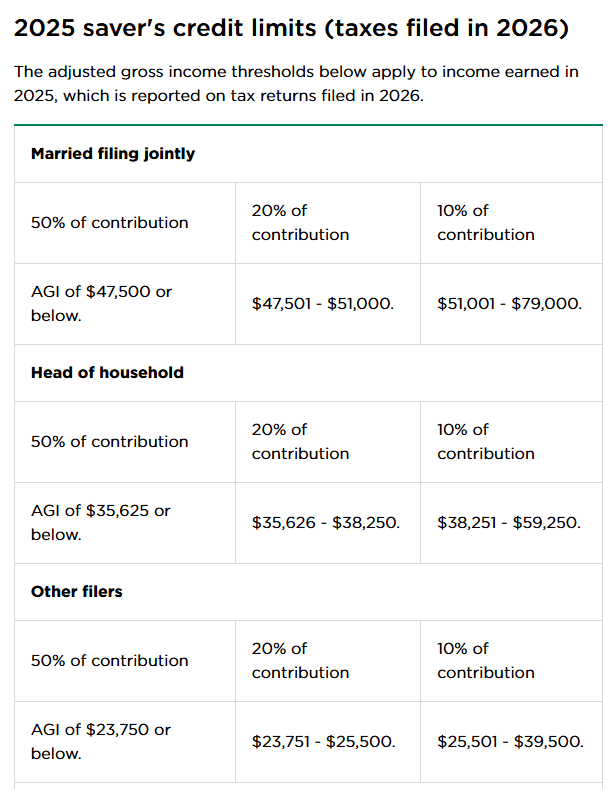

Applicable for lower income pastors, you may also be eligible for a credit for contributions to your 403b. Depending on your adjusted gross income reported on your Form 1040 series return, the amount of the credit is 50%, 20%,10%, or 0% of contributions made based on your income. See 2025 saver’s credit limits below:

SUSAN CARPENTER

Director of Finance

954-785-2220, x.304

scarpenter@vibrantpresbyter.org